Create an initial long list of all of the investors that you would like to target, including individuals and funds. Undertake some background research on each to whittle the list down.

We recommend tagging those investors whom you intend to approach first. You may not want to approach preferred investors first so that you can gather some initial feedback before approaching your preferred investors.

Track progress with each investor, including any phone calls, meetings and keep a log of what information has been sent.

Seed capital is typically raised from:

A round can comprise investors under one or a number of these categories. When considering the optimal make up for your round, take the following into consideration:

As a first step, it is preferable to secure an “anchor” or “lead” investor. You may wish to discuss pricing and terms with the lead investor before settling on what to present to the broader network.

Approaching friends, family or your own business connections is relatively straightforward. The task becomes harder when you start approaching individuals that are not already known to you or the business. A lot of companies use LinkedIn, but this had led to some level of investor fatigue. Personal introductions are preferable but also rely on networks that you may not be a part of.

There are a number of organisations that specialise in raising investment from business angels and high net worth individuals, and hold the permissions and processes required to put investment proposals to them. These include brokers, angel syndicates and crowdfunding platforms.

The majority of Seed, SEIS and EIS funds are set up such that they are easy to get in touch with. Any initial outreach should include a succinct summary of the business and investment opportunity, with the investor presentation (assuming you are not putting in place an NDA) attached.

Try to personalise the communication – it is worth the investment of time – as investors will be wary of applications that look carbon-copied.

We generally suggest a staged approach – flooding the market with investment requests risks making the business look desperate. Investors are also always on the lookout for proprietary deal flow, i.e. investment opportunities that other investors haven’t yet come across.

This is a balancing act that should take place over at least a few weeks, so that feedback can be taken into account and relationships can be built.

A number of organisations host speed-dating-style events and pitching events which can help raise the profile of your fundraise if you are struggling to gain traction on a one to one basis with investors.

In all instances, try to meet with potential investors, as they will want to get to know you before committing any funds.

Be prepared to receive a high number of “no’s” – this is very common and even the most successful businesses receive them. Try to gather feedback from investors who decline to participate but don’t take the feedback too literally either. One of the most common reasons for investors to decline is that they lack sufficient confidence in the founders or the team. This may be rectified through pitching practice or team changes; but it is seldom given as a reason for decline.

The most common reason for decline is that a business has not yet “demonstrated sufficient traction”, or is “too early” in its development. This may also be accompanied with a list of milestones that the investor would like to see reached before they would consider investing. This, again, should be interpreted with some level of scrutiny, as it is the easiest and least offensive way to decline an investment opportunity and often, unfairly, leads to false hope and false starts.

Investment opportunities that resonate with investors will get a lot of attention and will often oversubscribe quickly. If you continue to receive a high number of “no’s” from a variety of sources, then it is best to pause and try to diagnose what isn’t resonating.

Here are some of the most common reasons for decline that we have come across in our experience as investors:

Our Investment Partners can shed some candid light on where the problems may be and whether they should be addressed through changes in the business, improvements in the investor materials or better curation of the type of investor to approach. You can view our consultancy options via your dashboard.

The investor presentation and a meeting with you is usually sufficient for an investor to decide whether they would like to explore further. Individuals may have little more than a few additional questions. Sophisticated investors and funds will request the business plan / financial forecast and may have a list of follow up questions to further assess the opportunity.

If the response is positive, individual investors will expect the company to issue a term sheet. Seed funds are more likely to put forward their own term sheet.

Venture rounds are normally led by an institutional venture capital fund but may also include seed funds, EIS funds, family wealth funds (also known as family offices), angel syndicates / platforms, corporate venturing funds, high net worth individuals and match funders.

Typically, a lead investor is sought to provide all, the majority or the largest portion of the round.

You can use our investor database to run various searches to populate this list – the database includes a number of institutional funds and funding organisations (but it is not exhaustive).

With an initial long list, use our profiles and the fund’s websites to undertake background research on each to understand the following:

Depending on each investors’ suitability and the strength of alignment, there are likely to be some funds you consider to be a “long shot” and others that are more achievable. It is sometimes helpful to approach those you consider fall into the latter category in order to test the pitch and gather initial feedback, before approaching others.

There is an element of momentum in securing investment. Starting conversations too early can have a detrimental effect if the business is not ready for early due diligence. Very early conversations should be positioned accordingly, so the investor is aware that you consider it an initial discussion and are not yet intending to commence a process. This will manage their expectations with regards to requests for further information and follow up, and give you time to prepare.

The majority of institutional funds are set up such that they are easy to get in touch with. A common misconception among small businesses is that they must secure a personal introduction in order to be considered for investment – while this can help prevent an application from being overlooked, it is unlikely to sway the judgement of the investor once an application has been received. There is a notable difference between an introduction and a recommendation – the latter of course may carry some influence. The quality of the investor presentation and the initial interaction with the management team will ultimately define whether an investment discussion is progressed. We therefore suggest spending sufficient time preparing the business before approaching investors and ensuring the presentation makes the right impression.

Initial outreach is usually in the form of an email, with the objective being to set up a meeting. An introductory email should include a short summary of the business and investment opportunity and should be tailored to each fund. The email should ideally reference why you are reaching out to that particular fund, for example, they have indicated an interest in the sector through a recent investment, or briefly why you feel there may be a good fit. The investor presentation should be attached to the email (assuming that you do not intend to put an NDA in place first).

While a significant number of “no’s” at the seed stage is usually no cause for concern, at the venture stage, this should not be ignored. The variability in the investment appetite of venture investors is narrower than that of seed investors and individuals, and therefore it is more important to address the cause for decline as it is likely to apply to other funds.

A number of “no’s” are issued as a result of poor communication of the business and investment proposition. Not being aware that this is the case, investors will not cite this in their feedback. It is important to look critically and objectively at your investor materials to ensure they are adequately communicating the investment opportunity.

If this is not the case, then there are concerns with the investment proposition, the business and/or the team. Seek feedback from declines so that you can understand where the concerns lie and address them.

The majority of companies attempting to fundraise do not manage to do so on first attempt, but many go on to do so at a later stage when their business becomes more investable or certain milestones are reached.

The feedback loop in the venture capital and private equity industry is relatively weak and not always accurate, given the sensitivity in rejection. Here are some of the most common reasons for decline that we have come across in our experience as investors:

Our Investment Partners can shed some candid light on where the problems may be and whether they should be addressed through changes in the business, improvements in the investor materials or better curation of the type of investor to approach. You can view our consultancy options via your dashboard.

A successful first meeting will usually result in a number of requests for further information, for example, the business plan / financial forecast.

The majority of institutional funds have an Investment Committee, which reviews and approves proposed investments. An individual investor or a “deal team” will work with you to prepare their recommendation for Investment Committee, usually in the form of a short written paper. The process followed and the decisions for which Investment Committee approval is required varies between funds, and therefore it is worth asking any funds that wish to progress discussions what their process is.

The next key milestone for discussions is the agreement of a term sheet – ordinarily provided by the fund or funds interested in participating.

Growth capital is typically sourced from dedicated growth capital funds or the growth capital arm of a larger private equity fund. These funds may be structured as traditional private equity funds or may be dedicated venture capital trusts.

Growth capital may also be sourced from corporate venturing funds, mezzanine providers, venture debt funds, family wealth funds (also known as family offices) and Government-backed funds.

While some funds co-invest, the majority of growth capital rounds are completed with a single investor, and may also involve exiting prior investors, as they hand over to the new investor.

You can use our investor database to run various searches to populate this list – the database includes a number of institutional funds and funding organisations (but it is not exhaustive).

With an initial long list, use our profiles and the fund’s websites to undertake background research on each to understand the following:

Depending on each investors’ suitability and the strength of alignment, there are likely to be some funds you consider to be a “long shot” and others that are more achievable. It is sometimes helpful to approach those you consider fall into the latter category in order to test the investor presentation and gather initial feedback, before approaching others.

There is an element of momentum in securing investment. Starting conversations too early can have a detrimental effect if the business is not ready for early due diligence. Very early conversations should be positioned accordingly, so the investor is aware that you consider it an initial discussion and are not yet intending to commence a process. This will manage their expectations with regards to requests for further information and follow up, and give you time to prepare.

The majority of institutional funds are set up such that they are easy to get in touch with. A common misconception among small businesses is that they must secure a personal introduction in order to be considered for investment – while this can help prevent an application from being overlooked, it is unlikely to sway the judgement of the investor once an application has been received. There is a notable difference between an introduction and a recommendation – the latter of course may carry some influence. The quality of the investor presentation and the initial interaction with the management team will ultimately define whether an investment discussion is progressed. We therefore suggest spending sufficient time preparing the business before approaching investors and ensuring the presentation makes the right impression.

Initial outreach is usually in the form of an email, with the objective being to set up a meeting. An introductory email should include a short summary of the business and investment opportunity and should be tailored to each fund. The email should ideally reference why you are reaching out to that particular fund, for example, they have indicated an interest in the sector through a recent investment, or briefly why you feel there may be a good fit. The investor presentation should be attached to the email (assuming that you do not intend to put an NDA in place first).

A common mistake among businesses seeking to fundraise is to approach many investors at once in the hope that probability will dictate that one will invest. It is a relatively small industry and investors think in a similar way, and therefore it is important to assess the situation when a “no” is received.

A decline is a result of either:

A. A failure in communication: the investment materials do not adequately reflect the quality of the investment opportunity; the investor is time-poor and has come to the conclusion that it is not sufficiently interesting.

B. Issues with the investment proposition: there are a vast array of potential reasons for this. We explore further below.

C. Mismatch in mandate: the business does not fit with the fund’s specific investment criteria.

Whichever category a decline falls into, all require some form of action in response:

A. Improvements to the investment materials to better communicate the investment opportunity.

B. Changes to the business, valuation or team.

C. Deeper research into investor mandates prior to approach.

Here are some common reasons for decline under each category, that we have come across in our experience as investors:

A failure in communication

The investor presentation:

Issues with the investment proposition

Mismatch in mandate

It can be difficult to ascertain which category each falls into, but you can try the following:

Our Investment Partners can shed some candid light on where the problems may be and whether they should be addressed through changes in the business, improvements in the investor materials or better curation of the type of investor to approach. You can view our consultancy options via the "Get help" link or your dashboard.

A successful first meeting will usually result in a number of requests for further information, for example, the business plan / financial forecast and a list of specific questions.

The next key milestone is a term sheet. This may require approval by the fund’s investment committee first.

Key investment decisions are approved by the fund’s Investment Committee. One or a number of individuals that work within the fund’s investment team will work with you to prepare their recommendation for Investment Committee, usually in the form of a short, written paper. The process followed and the decisions for which Investment Committee approval is required varies between funds, and therefore it is worth asking any funds that wish to progress discussions what their process is.

Regardless of whether a committee meeting must be held prior to a term sheet, the investor will ask a significant number of questions and may wish to meet a number of times. Their line of questioning can sometimes come across as negative or critical, which can lead some companies to believe that they are unlikely to secure investment. The implication is quite the opposite during this phase of the process – the investor wants to be fully prepared for their internal committee which will not hold back on challenging questions. Being prompt with responses will reduce the length and complexity of this part of the process.

Alongside assessing the opportunity, the commercial elements of the deal will also need to be discussed. Investors typically explore this with you before putting forward a term sheet, to ensure there is some alignment. This will involve conversations around structure and terms.

A cap table (capitalisation table) summarises the ownership of a business pre and post a fundraise, demonstrating the full breakdown of the Enterprise Value, including shareholders, debt and cash.

It is an essential tool that enables you to see the mechanics of your individual fundraise and to calculate specific figures for the legal documents, for example:

We have built an easy-to-use cap table template specifically for seed rounds.

All you will need to complete the template is:

Step by step instructions are included within the template, which is built using basic Excel formulae and thus can be tailored to fit your business and fundraise.

There are also a number of built-in checks in the model below the cap table. If any of these show an error, you'll need to check your inputs:

A cap table (capitalisation table) summarises the ownership of a business pre and post a fundraise, demonstrating the full breakdown of the Enterprise Value, including shareholders, debt and cash.

It is an essential tool that enables you to see the mechanics of your individual fundraise and to calculate specific figures for the legal documents, for example:

We have built an easy-to-use cap table template specifically for venture rounds where new equity is being issued.

All you need to complete the template is:

Step by step instructions are included within the template, which is built using basic Excel formulae and thus can be tailored to fit your business and fundraise.

There are also a number of built-in checks in the model below the cap table. If any of these show an error, you'll need to check your inputs:

A cap table (capitalisation table) summarises the ownership of a business pre and post a fundraise, demonstrating the full breakdown of the Enterprise Value, including shareholders, debt and cash.

It is an essential tool that enables you to see the mechanics of the fundraise and to calculate specific figures for the legal documents, for example:

We have built an easy-to-use cap table template which encompasses an option pool (if needed), cash out (if needed) and the issuance of equity.

All you need to complete the template is:

Step by step instructions are included within the template, which is built using basic Excel formulae and thus can be tailored to fit your business and fundraise.

There are also a number of built-in checks in the model below the cap table. If any of these show an error, you'll need to check your inputs:

This resource will guide you through what to include in an investor presentation for a Series A or B round with venture capital investors. A template is included if required, though it’s also fine to use a company branded template.

The purpose of an investor presentation is to effectively and persuasively communicate the opportunity to invest in the business. It should be a standalone document that will most likely be the first source of information an investor uses to assess the opportunity.

We suggest sending your presentation to potential investors in advance of meeting them, so that they have time to prepare.

Include a short paragraph that describes the business and what it does. This paragraph should be simple, specific and easy to read.

This slide should set out the problem or market need the business is addressing or aiming to address. Use facts and figures to back up claims made wherever possible.

Explain how the business addresses the problem or market need.

This is often the first opportunity to “lose” investors - if they come to the conclusion that they have seen other businesses doing what yours is doing and they are not inclined to read any further. This next slide is therefore key in highlighting why your business is approaching the problem / challenge / market need / solution in a differentiated way, and is worth finding out more about.

These points should be short, specific and memorable.

Set out key milestones and achievements since the business was founded. This can either be done through a timeline or under KPI headings.

Milestones will be highly specific to your business but could include:

This slide should ideally send the message that the business is gaining momentum, and that any prior investment has been deployed effectively.

The purpose of this slide is to illustrate to investors how the business makes money or generates value. If the business is loss making, then this slide should illustrate how the model will eventually make a profit or generate cash.

The level of detail and approach used here will depend on what your business does and how established it is, but for almost all businesses, this can be demonstrated in three stages:

Turnover / income / cash in

Costs / investment / cash out

Profit / net cash

This covers the finer details of the product or service provided and should demonstrate proof of concept and traction with customers. You may want to include infographics, photos and screenshots here.

Include statistics on secured customers and customer / sales pipelines where relevant, along with short testimonials. Include any relevant information on technology and IP.

We cannot emphasise enough the importance of the management team to investors that hold minority equity stakes. They are backing you and your team so this slide and the next slide are very important.

Many companies fail to distinguish between board-level directors and other key executive management – it’s helpful to show the distinction for investors at this stage so that they can understand the makeup of the board as they may wish to join it or to appoint a Chairman.

This slide could also include advisors or members of the advisory board – support and buy-in from industry names can enhance credibility.

Biographies should be specific and appropriately detailed.

As the Board is likely comprises only a few individuals, you may need another slide to include the details of other key members of the executive team. This slide should also list key information such as total number of employees, locations of offices and roles that are to be filled.

This slide sets out the current ownership of the business (including any prior external investors, including seed investors) and the investment that is being sought.

At a minimum, it should set out how much funding is sought. Pricing is not essential but if you have a clear idea of the price at which you are willing to raise, then it can be included here.

Companies sometimes choose not to include proposed pricing and instead discuss this with investors first. Pricing expectations that are too high can sometimes result in companies receiving a “no”, even before an initial meeting. It is also worth bearing in mind that some venture funds invest through structures that have certain preferential rights, which complicate the implied valuation.

If you expect the fundraise to be EIS or VCT eligible (and intend to seek advance assurance), then include a note on this here.

This slide summarises what the new investment will be used for, ideally including specific figures for each. Include a short explanation of why each particular use is additive to the growth of the company and/or generates equity value.

The business plan slide illustrates the key figures that make up the business plan, assuming the new investment is raised and deployed. It may rely on further rounds, which should be noted here if so, or it may be that the business only requires the current round of funding to reach profitability and become self-funding. It is helpful to show data for historic trading to enable investors to compare forecast performance to historic performance.

List the key drivers and assumptions behind the projections.

The purpose of this slide is to guide investors in the key points that they should “takeaway” in making their investment decision (or the decision as to whether to meet with you). These investment highlights should be woven through the slides above, and this slide ensures they come to the fore.

Regardless of the structure of an investor presentation, investors think in terms of investment highlights and investment risks – do these highlights outweigh the risks?

This slide is often missed out of investor presentations, so it is also a helpful way to indicate to potential investors that you understand what they are looking for and have made the effort to put it into their language.

While the above slides constitute the key ingredients required for investors to judge the investment proposal, there are a number of areas of interest that are specific to certain businesses and certain sectors. Here are a few of our suggestions for additional slides:

Technology businesses

Leisure, restaurant, health, property or other site-based businesses

Consultancy and other B2B businesses

Consumer businesses

This resource will guide you through what to include in an investor presentation for a growth capital investment. A template is included if required, though it’s also fine to use a company branded template.

The purpose of an investor presentation is to effectively and persuasively communicate the opportunity to invest in the business. It should be a standalone document that will most likely be the first source of information an investor uses to assess the opportunity.

We suggest sending your presentation to potential investors in advance of meeting them, so that they have time to prepare.

Include a short paragraph that describes the business, what it does, the key opportunities that lie ahead and the investment that it sought. This statement should make an impact and can make use of aspirational language to set the scene.

This slide sets out the specificity behind the aspirational statement made on the previous slide. It should explain in simple language what the business does, and may include:

The slide is not intended to simply be a fact sheet – the points included here should demonstrate to investors the strength of the business as a whole, illustrating that it is established, growing and, if applicable, profitable.

The purpose of this slide is to guide investors as to the key points that you believe should form their investment decision. By highlighting these early on, you are asking the investor to keep them in mind as they read further about the business. The slides that follow should provide the evidence to back up the claims made on this slide.

Regardless of the structure of an investor presentation, investors think in terms of investment highlights and investment risks – do these highlights outweigh the risks?

This slide is often missed out of investor presentations, so it is also a helpful way to indicate to potential investors that you understand what they are looking for and have made the effort to put it into their language.

Set out key milestones and achievements since the business was founded. This can either be done through a timeline or under KPI headings.

Milestones will be highly specific to your business but could include:

This slide should ideally send the message that the business has continuing momentum and a strong track record of performance.

If the business has a long history and has only recently begun to experience rapid growth, be sure to provide sufficient emphasis on the latter, while providing an explanation of the former. There are many businesses that experience moments of “inflection” – making this clear may help to alleviate investor concerns about slow historic growth or progress.

This slide provides the finer detail around the product or service provided, helping potential investors to understand how or why the product or service is differentiated and / or superior.

This slide may include:

This should not be a repetition of the “About” slide, which is about this business. This slide is specifically about the customer-facing offering.

The purpose of this slide is to illustrate to investors how the business makes money or generates value. This will be different for each business. Some business models are best explained through Turnover – Costs – Profit, others through Cash In versus Cash Out, or simply through value drivers, or a combination of the above.

We suggest following a staged approach to make this clear, illustrated in our template presentation. If the business has multiple sources of revenue or multiple business lines, then a slide may be created for each stream.

This slide illustrates the key market dynamics that impact the business and underpin growth and value generation. This may include:

The aim of this slide is to illustrate the relative (and hopefully, superior) competitive positioning of the business.

This can be set out in a table that lists a series of features down the left hand side, with each column representing a competitor. One column should be your own business to show a side by side comparison.

The features listed here will depend on the industry but we suggest including some basic metrics, such as:

Followed by business / industry-specific priorities, for example:

The contents of the grey boxes can vary according to the particular feature. For example, ticks and crosses, ratings, pie charts or short sentences, may be used to best summarise the relevant feature.

This slide summarises the current make-up of the Board, including Executive and Non Executive Directors. It is important to distinguish between the Board and other members of the executive team as investors will most likely appoint one or two members of the board (including potentially a Chairman), so they will be interested in its composition.

The primary purpose of this slide is to demonstrate the strength of the leadership team. Biographies should therefore be specific and appropriately detailed. We suggest being specific about prior roles and companies, instead of saying “10 years’ experience in X”.

The strength of the team is of particular importance to minority equity investors and therefore relevant detail is important.

This slide could also include advisors or members of the advisory board – support and buy-in from industry names can enhance credibility.

This slide is to introduce members of the team that do not sit on the board but are in an executive capacity and key to the ongoing growth of the business.

It is worth highlighting certain roles that you intend to fill, or are in the process of filling.

The business plan slide illustrates the key figures that make up the 3 or 5 year business plan, that you are asking the investor to back.

The table or chart(s) should include:

To illustrate credibility in the forecasts, it is helpful to show recent history trading figures.

This slide should include a summary statement on what the business expects to achieve over the plan, perhaps building on recent successes, and should list the key driving assumptions.

Following a positive meeting, a potential investor will ask for the model that sits behind these forecasts, so it is best to prepare a model at the same time as preparing the investor presentation. It is also worth noting that once figures are presented, investors are likely to refer back to them as discussions progress. Any significant variances will require explanation and therefore having a suitably robust business plan prior to engaging in discussions can make the process easier.

This slide is optional and its inclusion will depend on whether you feel that you have good visibility of the key risks to the business plan and how the business is positioned to mitigate them.

Understanding and assessing the key risks to an investment opportunity is a key part of the investment decision made by investors – it is the logical next step after assessment of the investment highlights. Despite this, risk management is often led by investors, rather than companies. This can lead to misunderstandings or misalignment on what could derail the business plan.

Being upfront about these risks can help guide investors to the most applicable risks and thus where they should focus their research efforts. It also demonstrates awareness and management of risks and positioned the business to deal with shocks.

This slide may take the form of a list of key risks, a sentence or short paragraph explaining how and when the risk may impact the business, and the likelihood of such an occurrence, along with the corresponding mitigations, i.e. features or actions, either past, present or future, that exist or could be taken by the business to protect and respond.

This slide summarises the investment sought, the current ownership of the business and any relevant structural considerations.

It is not necessary to include a valuation proposal – though during a first meeting you may be asked for an indication so that the investor can ascertain whether they are “within range” of your expectations. Some companies choose to state specifically that they are seeking, or are open to, a combination of equity and loan notes.

If part of the investment is intended to purchase shares directly from existing shareholders or to cash out prior investors then this should be specified here.

This slide summarises what the new investment will be used for, ideally including specific figures for each. Include a short explanation of why each particular use is additive to the growth of the company and/or generates equity value.

While the above slides constitute the key ingredients required for investors to judge the investment proposal, there are a number of areas of interest that are specific to certain businesses and certain sectors. Here are a few of our suggestions for additional slides:

Technology businesses

Leisure, restaurant, health, property or other site-based businesses

Consultancy and B2B businesses

Consumer businesses

The first step in deciding how much capital to raise is to prepare a simple, monthly forecast cash flow. This should ideally forecast two years ahead but one year may also be sufficient.

If you don’t already have one, see our guide to building a financial model for a seed round. Our template includes a cash graph so you can easily see your cash profile.

Ensure that you include in your plan what you intend to invest the money in, for example, marketing expenses, new hires, investment in technology. If your cash does not go negative – you may not need to raise funding at all.

With your assumptions included, the cash flow will illustrate the quantum of cash required, equal to the lowest negative balance.

Add an appropriate quantum of headroom to this figure to calculate the total funding requirement.

While this will vary for each business and your risk appetite, one approach is to assume that the business should be able to survive for 3 months in the instance that all income ceases. This would give you a window of time to establish new income or raise funding.

Understanding your cash burn rate, that is, the rate at which your business depletes cash, is required to estimate this figure. Take your monthly cash burn rate, deduct your monthly income and multiply this by the number of months for which you want to "stay alive", say, three months. Now you have an estimate for what your cash headroom should be.

You may wish to add to this figure if:

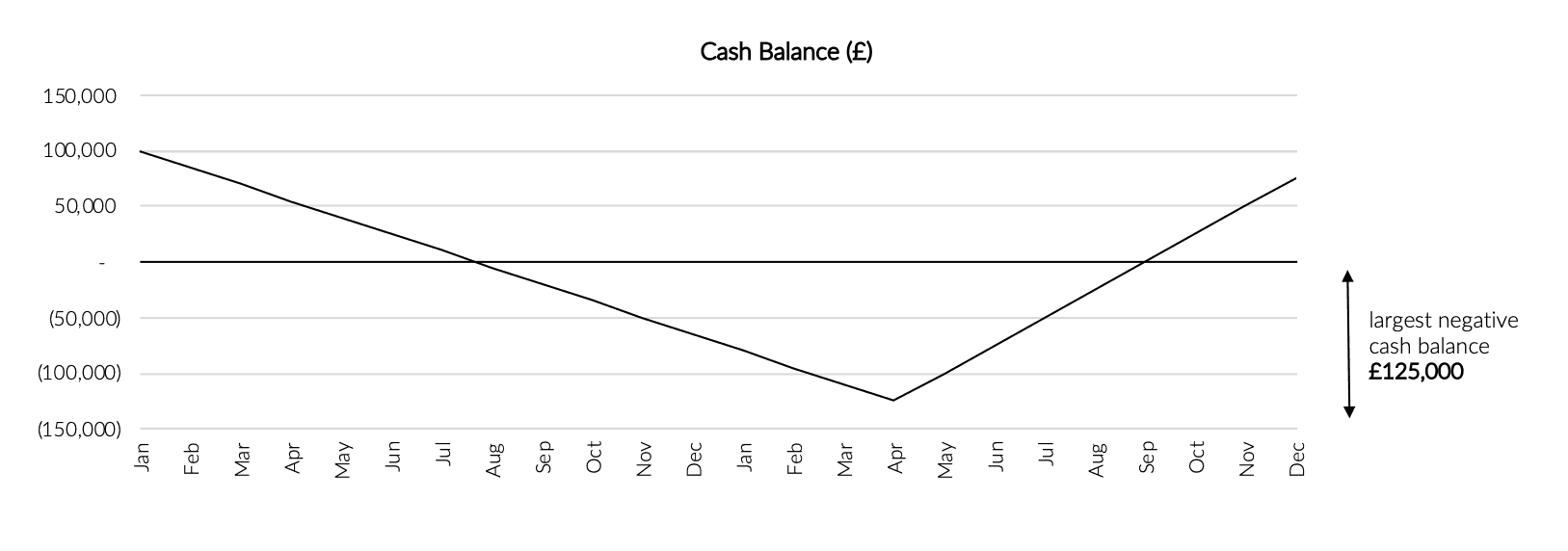

In this example the business is depleting cash because its costs exceed income; however, with turnover growing rapidly, this will soon reverse. Funding is required to sustain the business until this point is reached. The business is expected to run out of cash in August and reach a cash low point of minus £175,000 the following April.

The current cash burn rate is approximately £15,000 per month and monthly turnover is £10,000. An estimate of appropriate cash headroom is therefore:

The total cash requirement is:

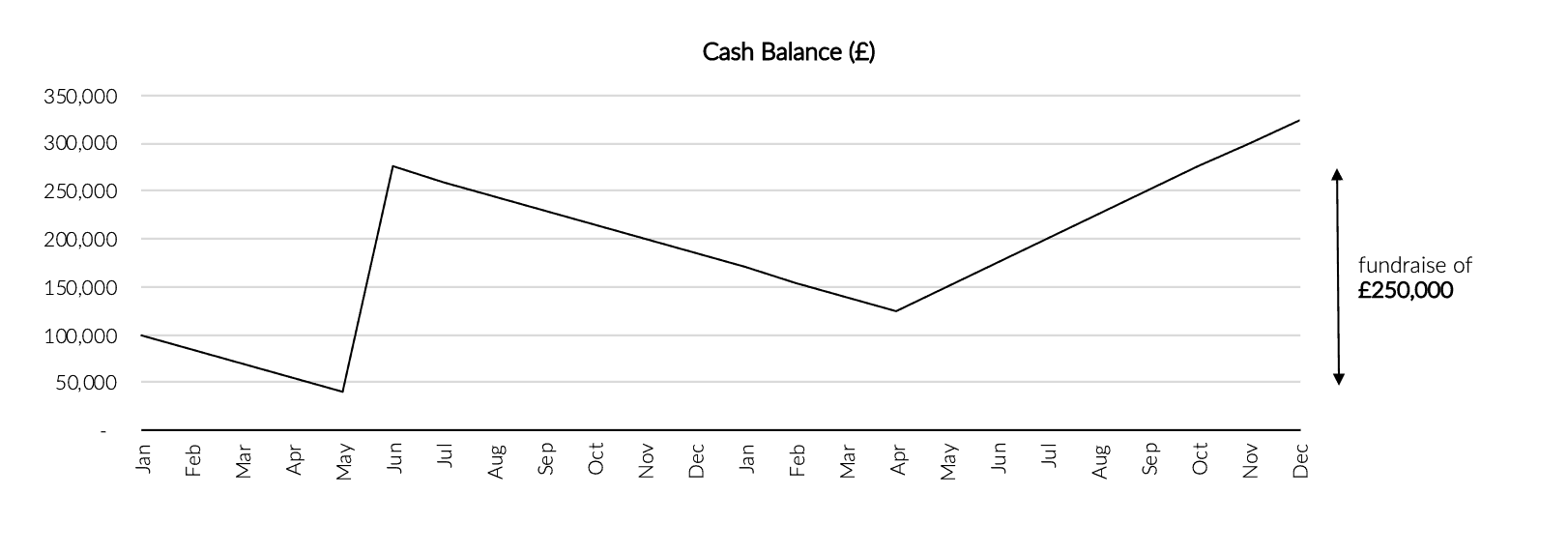

The business will start fundraising today, to allow sufficient time before cash reaches zero. Assuming a successful raise in June, the cash flow now looks like this:

In the example above, through turnover growth the business is expected to become profitable in the foreseeable future. The investment of £250,000 is sufficient to plug the cash gap until profitability is sufficient to fund future growth – this business may therefore not need further capital.

Many businesses require multiple rounds of financing as profitability will take longer to achieve or a more aggressive investment strategy is envisaged.

In this instance, your cash graph will continue to show cash depletion even with new investment. Investors will seek reassurance that enough cash is being raised. A general rule of thumb, for an initial seed round, is to ensure that the investment will provide sufficient cash headroom for at least one year post investment. This means that you expect to be doing your next round in one years’ time.

The alternative is to raise funding that covers a longer period, for example, two, three or even five years. Whilst this brings greater certainty of cash headroom, it comes with a few trade offs:

Assessing how much capital to raise requires an understanding of the company’s forecast financial performance and cash burn rate.

To do this, you will need to prepare a financial forecast model that includes a cash flow. If you don’t already have one, see our dedicated guide to creating a venture-stage financial model.

Ensure that you include in your plan what you intend to invest the money in, for example, marketing expenses, new hires, investment in technology. If your cash does not dip into the negative then you may not need to raise funding at all.

With your assumptions included, the cash flow will illustrate the quantum of cash required, equal to the lowest negative balance.

Add an appropriate quantum of headroom to this figure to calculate the total funding requirement.

While this will vary for each business and your risk appetite, one approach is to assume that the business should be able to survive for 3 months in the instance that all income ceases. This would give you a window of time to establish new income or raise funding.

Understanding your cash burn rate, that is, the rate at which your business depletes cash, is required to estimate this figure. Take your monthly cash burn rate, deduct your monthly income and multiply this by the number of months for which you want to "stay alive", say, three months. Now you have an estimate for what your cash headroom should be.

You may wish to add to this figure if:

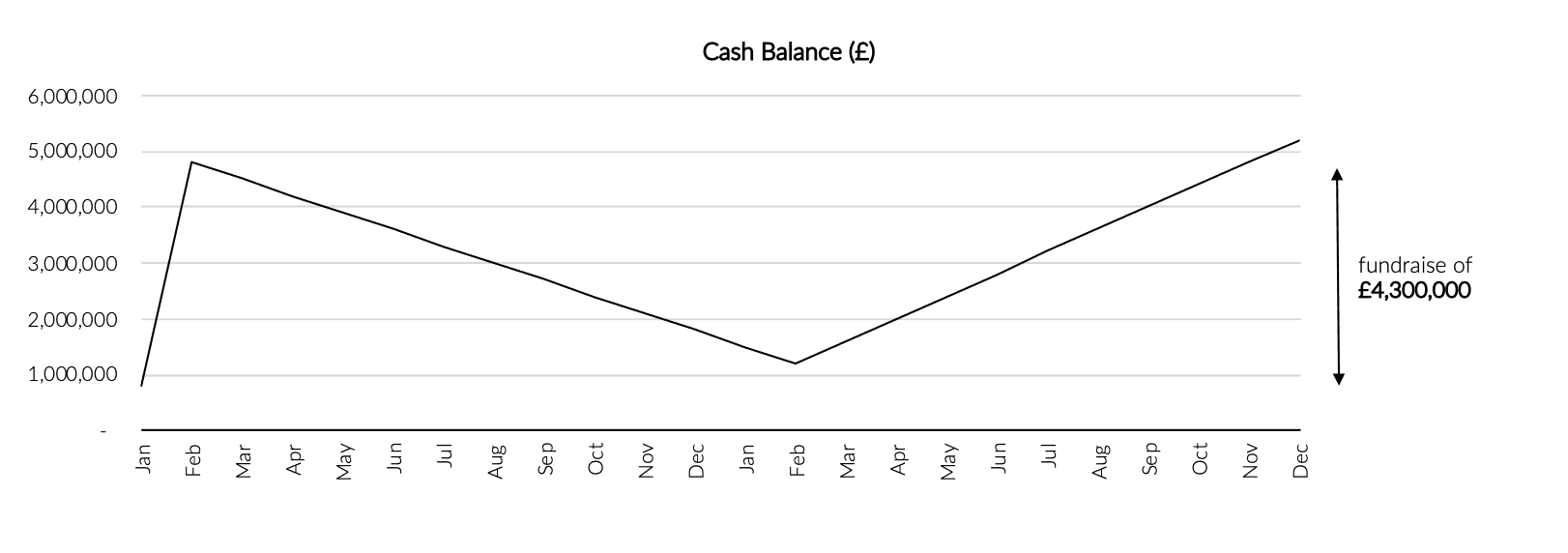

In this example the business is depleting cash because it is investing, and intends to continue investing, heavily in costs and capital expenditure, which exceed income. With turnover growing rapidly, the business is expected to become cash generative in approximately a years’ time.

Funding is required to sustain the business until this point is reached and allow it to continue to invest in growth. The business is expected to run out of cash in April and reach a cash low point of minus £3,100,000 the following February.

With significant investment in marketing and headcount, the cash burn rate is approximately £300,000 per month and monthly turnover is £100,000. An estimate of appropriate cash headroom is therefore:

The total cash requirement is:

Assuming a successful raise in February, the cash flow now looks like this:

In the example above, through turnover growth the business is expected to become profitable in the foreseeable future. The investment of £4,300,000 is sufficient to plug the cash gap until profitability is sufficient to fund future growth – this business may therefore not need further capital.

Many businesses require multiple rounds of financing as profitability will take longer to achieve or a more aggressive investment strategy is envisaged.

In this instance, the cash graph will continue to show cash depletion even with new investment. Investors will seek reassurance that enough cash is being raised. A general rule of thumb is to ensure that the investment will provide sufficient cash headroom for at least two years post investment. This means that you expect to be doing your next round in two years’ time.

The alternative is to raise funding that covers a longer period, for example, five years. Whilst this brings greater certainty of cash headroom, it often comes at a cost. A growing business that undertakes a larger round, to be deployed over 5 years, will typically incur higher dilution than an identical business that raises the same amount in smaller tranches over the period, assuming that the value of the company rises with time. Fundraising is exceptionally resource intensive and time-consuming, though, so there is a balance to be reached between raising enough cash and not too often.